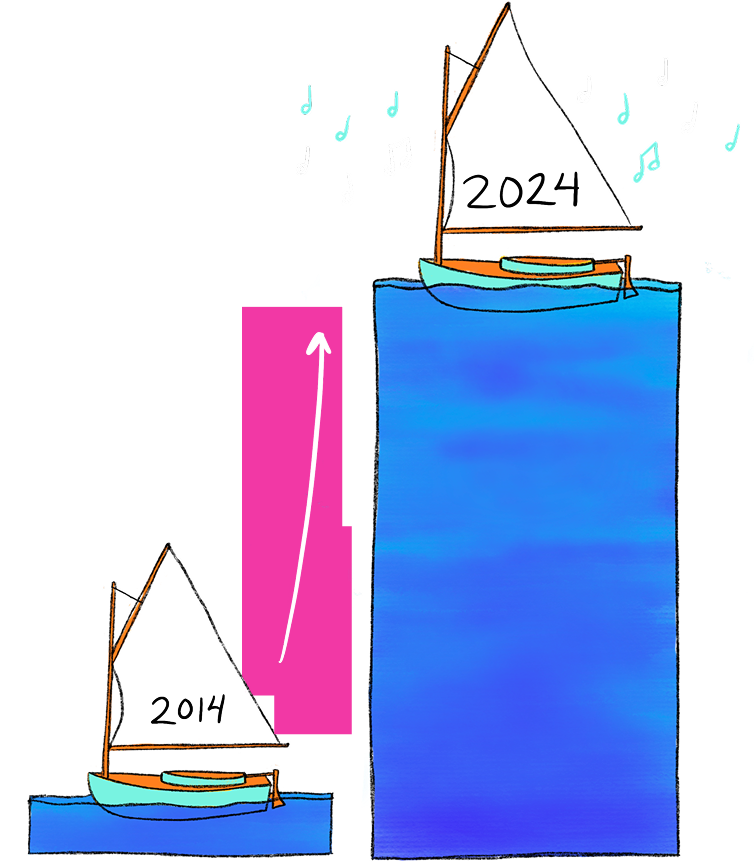

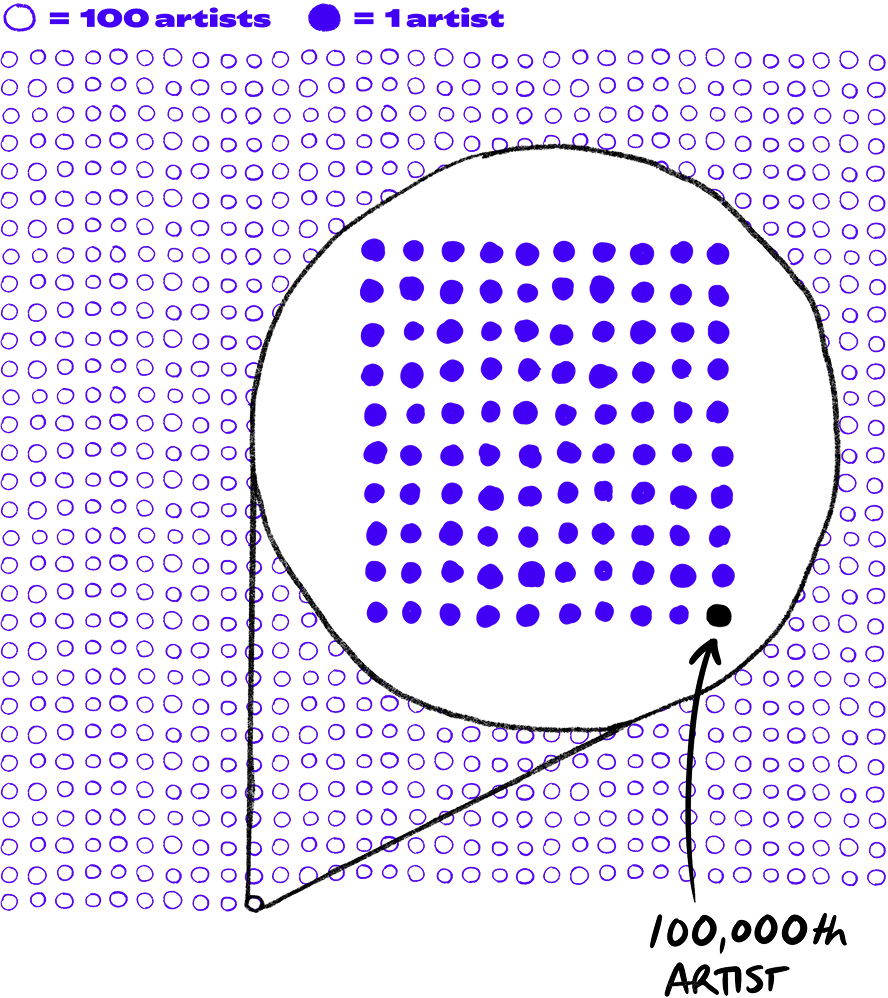

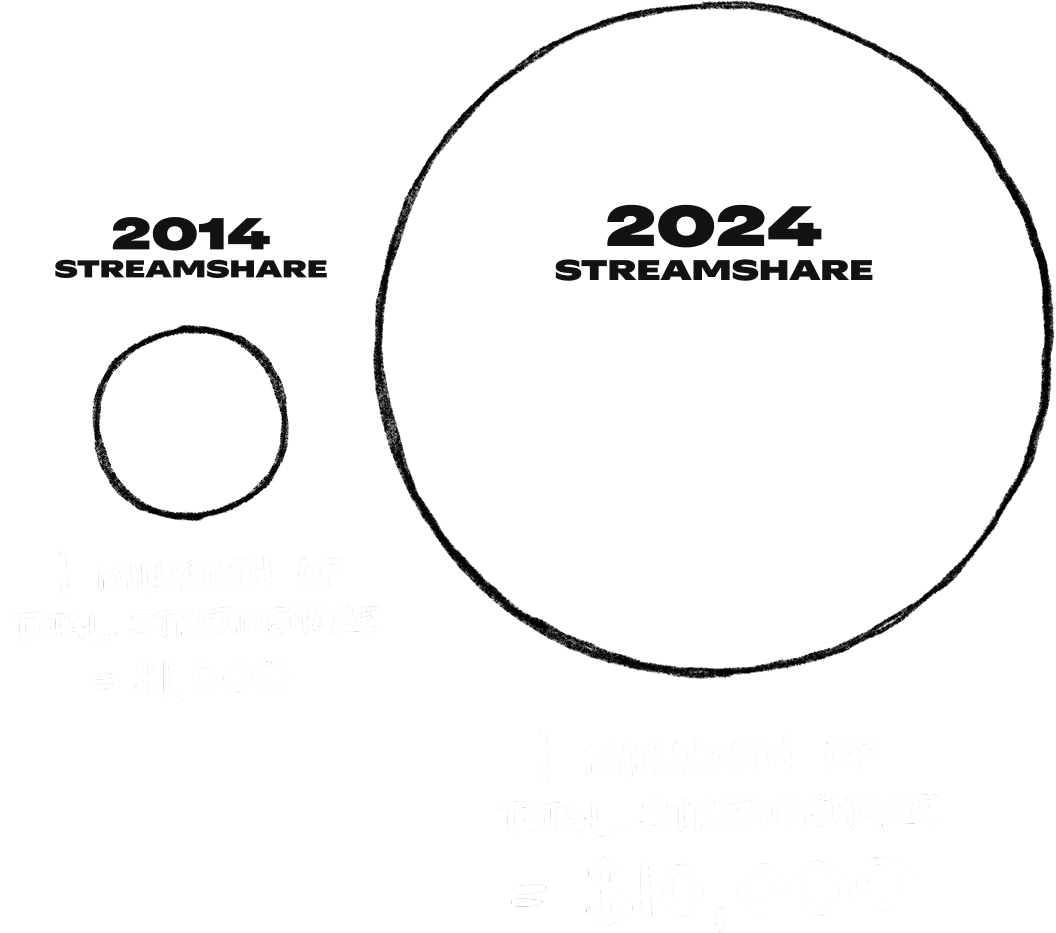

Over the past decade, the 100,000th-ranked* artist on Spotify has seen their generated royalties multiply by over 10x – increasing from well under $600 in 2014 to almost $6,000 in 2024.

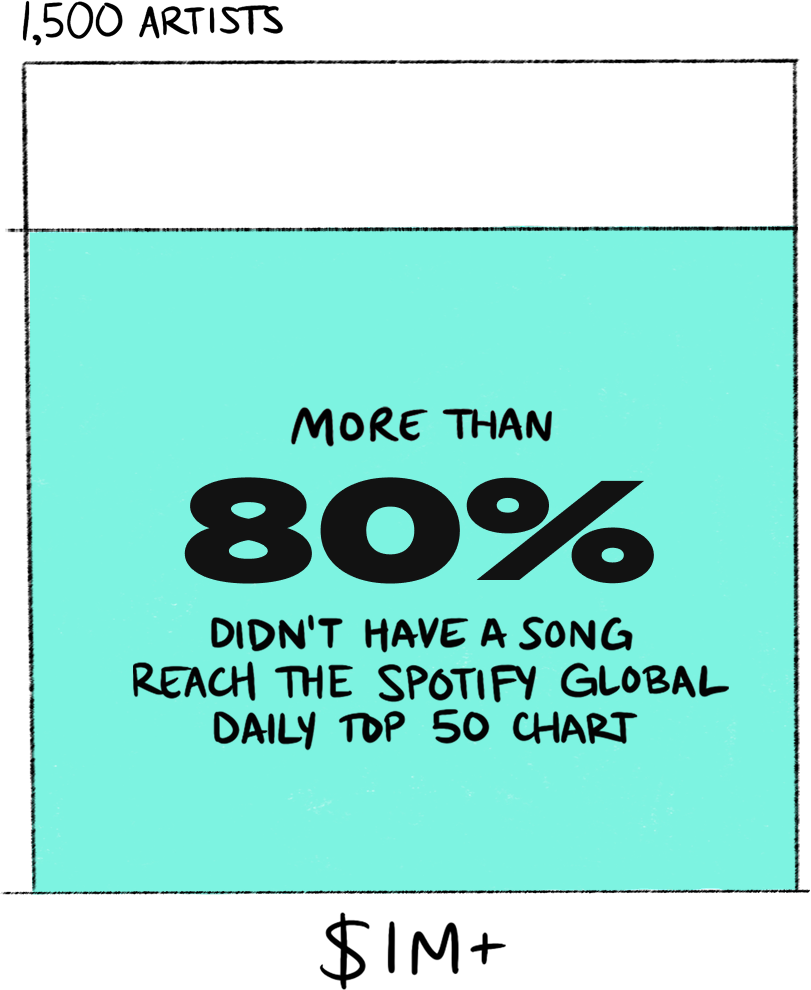

During that same time period, the 10,000th-ranked artist on Spotify has seen their royalties increase almost 4x – from $34K to $131K.

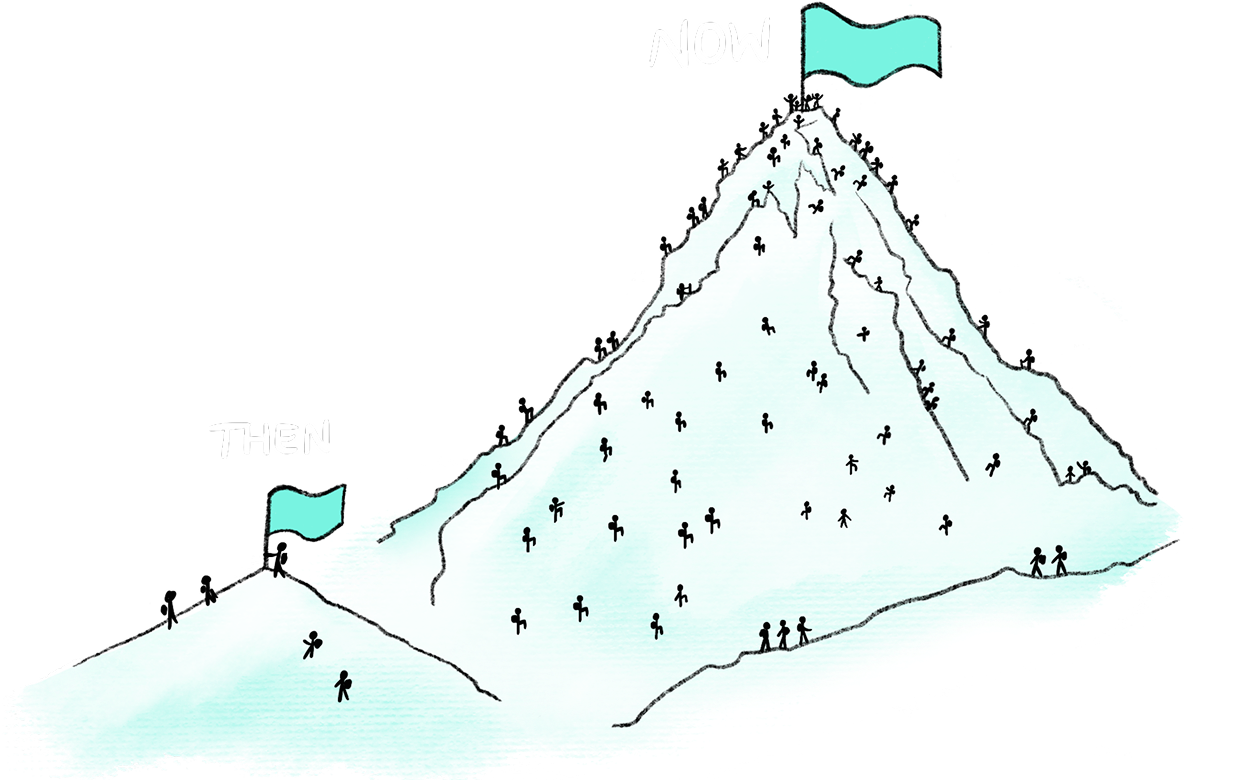

As a point of comparison, at the peak of the CD era, Tower Records carried only 50,000 CDs from thousands of artists in total (source). Today, however, over 100,000 artists are generating thousands in royalties on Spotify alone.

*Rankings are based on royalties generated, from highest to lowest.